Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

In a small business acquisition, there are generally two types of financing involved. We'll go through both types of financing in this blog and do a deep dive into an important characteristic of bank financing: the debt-service coverage ratio. Let's jump in.

Types of financing for small business acquisitions

The first is seller financing. This is when the seller lends the buyer a portion of the cost, in the form of an IOU. Typically, this IOU is structured as a promissory note. The promissory note may or may not have a personal guarantee by the buyer.

Seller financing is very common in “Main Street” transactions, as it helps align incentives. Because the selling owner has skin-in-the-game (e.g., an IOU that the buyer owes), the seller is incentivized to set the buyer up for success through customer and employee introductions, mentorship, and advice.

The second is bank financing. Bank financing can come in the form of a line-of-credit, a conventional loan or an SBA loan. Most bank-financed acquisitions worth more than $300K use an SBA loan, specifically the SBA 7(a) loan.

Unlike in the real estate market, the underwriting process for an acquisition loan is typically much longer than one month and involves lots of diligence on the business’s historic tax returns, financial statements, and operations.

During that underwriting process, the banks are often ensuring that the business has large enough earnings to yield a healthy debt-service coverage ratio, given the acquisition price being financed.

What is a debt-service coverage ratio?

To start, debt service is the sum of payments owed to a lender. This includes both the principal and interest payments. When analyzing a business’s ability to pay its debt service, a lender wants to make sure that a business earns enough money to comfortably make its monthly payments.

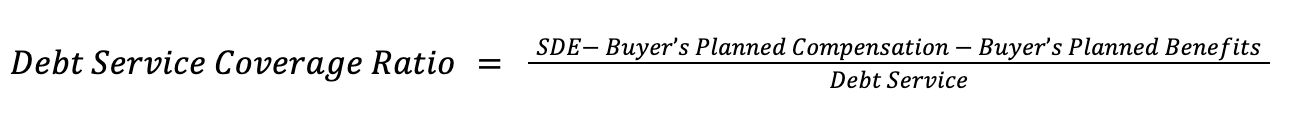

As part of that, a key metric to look at is the debt-service coverage ratio. This is the ratio of earnings to debt. For SMBs, the “earnings” are typically calculated by taking the seller’s discretionary earnings (SDE) and subtracting the buyer’s planned compensation and benefits. What’s left over are the true earnings that can be used to pay debt service, re-invest in the business, or treat the buyer to discretionary benefits.

What is a good debt-service coverage ratio?

Most SBA lenders will want a debt-service coverage ratio (DSCR) above at least 1.25. This means that for every dollar of debt owed in a year, the business will bring in one dollar and twenty-five cents of earnings.

More conservative lenders will want a debt-service coverage ratio above 1.5. This means that for every dollar of debt owed in a year, the business will bring in one dollar and fifty cents of earnings.

When calculating the DSCR, lenders will often take the debt service owed at the current acquisition price and then analyze the historic earnings over the past three years.

Why do lenders want a DSCR above 1?

Businesses can be unpredictable. A key customer may shut down or switch to another vendor. A foreman or crew lead may need to move out of town, reducing how many crews you can run. Someone may get hurt on the job. A pandemic may happen!

Banks want businesses to be able to withstand some amount of “life happening” without defaulting on their debt. If a business has a DSCR closer to 1, then the smallest adverse change can be the difference between on-time payments and default.

By having a DSCR of 1.25 or 1.5, a bank is ensuring the business has wiggle room on its loan.

At a 1.25 DSCR, a business can afford for earnings to fall by 20% before missing payments.

At a 1.5 DSCR, a business can afford for earnings to fall by 30% before missing payments.

What happens if the business’s DSCR is below the bank’s threshold?

If a business historically had a DSCR below a bank’s threshold, there are two paths forward:

Ensure the business has higher earnings

Lower the amount of debt service owed

At the point when a lender is looking at a business, it’s normally too late to generate higher earnings. The only way a buyer or seller can show more cash flow for debt payments is if the buyer plans to take less compensation or benefits. However, this cannot be unreasonably low.

What’s more common is to figure out how to lower the amount of debt service owed. Lowering the amount of debt service owed can come from a higher down payment from the buyer, a longer period on a seller note (meaning each year less is paid in total), or a reduction in the asking price.

The most common solution for a low DSCR is for the seller to reduce the asking price such that the business’s historical cash flow can support paying off the debt needed to buy the business at that price.

At Beacon, we only list healthy, cash-flowing, businesses that we've verified ourselves. Most of our customers are using at least some bank financing so it's important that the underlying business is lendable in terms of DSCR and a variety of other characteristics. Get started today.

Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

Will founded Beacon with the mission to help the current generation of owners to retire while enabling the next to unleash their entrepreneurial spirit. He comes from a business background having graduated from the Wharton School with a B.S. in Economics.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino