Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

What is an SBA loan?

Financing is an important issue for every potential small business owner. While there are options to get personal loans for your business, the interest rates (if you qualify) are quite high. To support small business owners in receiving financing, the federal government introduced the SBA in 1953.

The Small Business Administration (SBA) loan is a government backed-loan provided to small business owners by financial institutions like banks and credit unions. This is an affordable financing method set up by the government to support small business owners by insuring loans up to $5 million. Having the government act as a guarantor allows small businesses owners to qualify for loans that they otherwise would not have been able to.

Since this is a bank loan, applications are sent to the SBA-approved lenders, and loan payments are made to the bank. However, in the case that the borrower defaults, the SBA will repay up to 85% of any loss. This safety net makes small businesses owners significantly less risky, encouraging them to lend at affordable rates.

As a buyer, defaulting would be a bad outcome for you as well. At Beacon, our buyer community helps buyers make good purchase decisions with educational resources, deal analysis tools, and a community of entrepreneurs and industry experts.

Can I buy a business using an SBA loan?

Yes! SBA loans are acquisition loans and can be used for a range of business purposes including debt refinancing, working capital, equipment acquisition, real estate purchases, and buying a business - including both franchise and other business purchases.

How do I apply for an SBA loan?

The SBA application process can be broken down into 4 simple steps.

Choose your type of loan

Prepare your documents

Submit your application

SBA 7(a) Guaranteed Loan Program

Within the SBA lending program, the 7(a) guaranteed loan program is the SBA’s primary lending program. These loans typically range from $25,000 to $5,000,000 and are repaid in monthly installments.

The maximum maturity rates are as follows:

25 years for real estate

10 years for equipment

10 years of working capital or inventory loan

Within the SBA 7(a) guaranteed loan program, there are several streamlined loans for small business owners that need financing expedited.

Preferred Lender Program (PLP)– The SBA PLP program allows a select group of lenders to approve SBA loans independently. These loans are guaranteed by the SBA typically within 24 hours of their request and operate under the guidelines of a regular 7(a) guaranteed loan.

SBA Express Loan Program– Similar to the PLP program, the lender has unilateral credit approval authority. However, the SBA only guarantees up to 50% for SBA Express loans. This program was designed to make it easier and faster for lenders to provide a loan of $350,000 and less. These loans are also guaranteed by the SBA typically within 24 hours of their request.

SBA Veterans Advantage– An SBA Express Loan that waives the guaranty fee (currently 0.52%) for small businesses owned and operated by veterans, active-duty military in TAP, reservist or National Guard members, or a spouse of any of these groups, or a widowed spouse of a service member or veteran who died during service, or a service-connected disability.

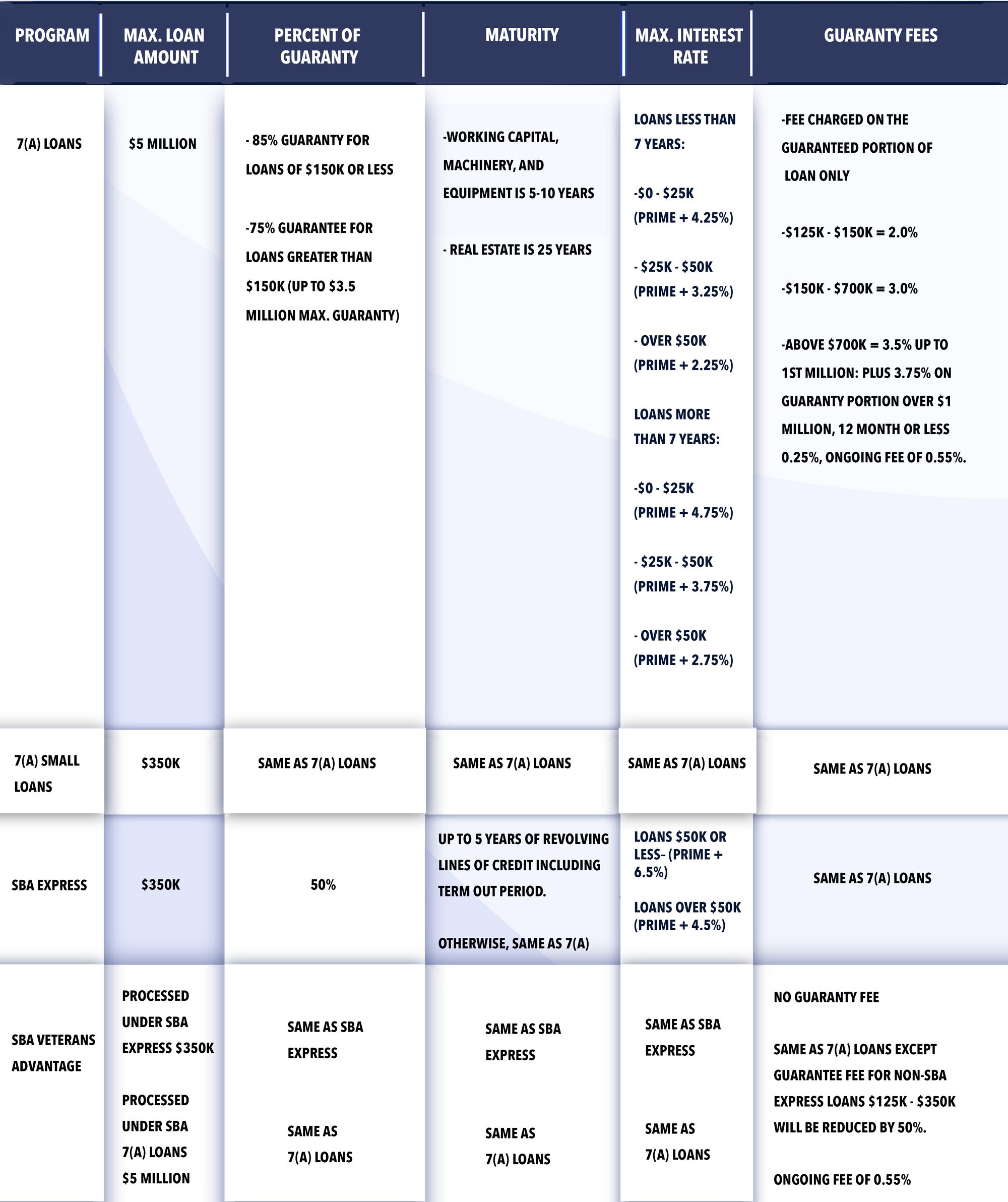

Breaking down the different kinds of loan programs.

SBA Personal Requirements

The SBA has some general requirements to test creditworthiness as qualification for a loan.

1. Repayment Ability – You must show that you have a history of creditworthiness, you can meet business expenses, owners draw and loan payments from the business earnings.

A record free of any bankruptcies

At least a 10% down payment

SBA Loans for Franchise Purchasing– All franchise fees must be paid before the loan funds are released.

2. Management – You must display an ability to manage your business. This can be displayed through past experience, especially for start-ups.

Industry or managerial experience

3. Equity – You must display that you have enough of your own equity at stake. The rule of thumb is a 3:1 Debt/Equity ratio for new businesses and a 4:1 Debt/Equity ratio for established businesses.

4. Credit History – You must display an upstanding credit history for both you and your business.

Credit history of 690 or higher

A clean criminal history or ability to explain any misdemeanors

SBA Loan Requirements for Businesses

Must be a small business by SBA definition

Your business cannot be engaged in speculation, lending, investment, or rental real estate.

All alternative financing resources, including personal assets must be exhausted before seeking financial assistance. The funds must also not be otherwise available on reasonable terms. (If a bank offers you the loan without an SBA guarantee)

The loan cannot be used to pay off inadequately secured creditors

The applicant cannot be a non-profit enterprise. (Non-profits have a grant from SBA)

Be engaged in or propose to do business in the U.S or its territories

SBA Collateral Requirements

The SBA does require borrowers to offer all available company assets as collateral, and if that is insufficient to fully secure the loan amount, liens on personal assets may be required. This is often in the form of liens on residential real estate. However, if sufficient collateral is simply not available, that alone will not hurt the borrower’s chances of loan qualification.

SBA Guarantor Requirements

All SBA loans require at least one guarantor. Any individual who owns 20% of more of the business must provide an unlimited full guarantee. In the case that no individual owns 20% or more of the business, at least one of the owners must provide a full unconditional guarantee. Additionally, if the spouse of the stakeholder owns a percentage that in combination with the stakeholder’s ownership is 20% or more of the business, both spouses must provide a full unconditional guarantee.

SBA Documentation Requirements

The SBA requires several documents to be submitted to the lender in order to apply for SBA Loans. The documents for SBA 7(a) include:

Borrower information form

Personal background and financial statement

Statement of personal history (and SBA)

Personal financial statement (SBA)

Business financial statement

Year-End P&L Statement (past 3 years)

Year-End balance sheet (past 3 years)

Projected financial statement (for at least 1 year)

Business certificate/license

Loan application history

Income tax returns of owner and business

Resumes of owner

Business overview and history

Business lease

Additional documents to buy an existing business include:

Agreement to purchase the business

Letter of intent to buy the business

Business tax returns (past 3 years)

Long term business contracts

Business lease agreement

These loan documents can often be complex to many first time buyers and getting them right might take longer than expected. Joining our Beacon Community can help you expedite this process through community interactions and get you your SBA loan approved as soon as possible.

How long does it take to get an SBA loan approved and closed?

Due to the high volume of documentation and paperwork required, an SBA loan can take anywhere between 60 days at the earliest to 90 days to be approved and closed.

You can always take the expedited route through the SBA Express Loan if you need the loan approved and closed quickly. Although SBA guarantees that the loan will be approved or declined in 36 hours, the paperwork involved and the timeline from the lenders can easily extend it to anywhere between 30 - 60 days.

Cons of an SBA Loan

While the SBA can be a great financing tool for many small business owners, it also comes with its own downsides.

SBA will not lend to you if your business falls under these sectors

Loan packaging, speculation, multi-sales distribution, gambling, investment, or lending

Real estate investment firms

Dealers of rare artifacts

Pyramid sales plans

Charitable, religious, or other non-profit institutions.

SBA does not allow for complex earn-outs.

The transition time between owners is limited to 12 months of closing when using an SBA loan.

Next Steps

If you're starting to think about buying a business, Beacon offers a customized alerting service to inform you when businesses that meet your criteria come available for sale. And then you can engage the buying process with Beacon. Sign up here:

Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

Robin is a community manager and content writer at Beacon. He is a sophomore at Virginia Tech's Pamplin College of Business, double majoring in Finance & Philosophy, Politics, and Economics.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino