Explore your options

Get a 100% confidential and complimentary business valuation.

If you take a look at most business-for-sale listing sites like BizBuySell or BusinessBroker.net, you’ll immediately realize that few of the small businesses for sale reveal their names. Even more so, many listings have vague locations, such as “Orange County, CA”.

Why don’t owners disclose the identity of their businesses?

When going through the process of selling a small business, most business owners keep the business sale confidential. As nothing is ever final until money exchanges hands, publicly announcing the intended sale of a business can cause problems with customers, employees and partners. In fact, more often than not these problems can lead to the business being worth less than it was before the intended sale was announced.

Let’s dive into some examples on why confidentiality matters.

How could customers react to the sale of a business?

Imagine that you went into your favorite pizza joint and the owner tells you that he’s planning on selling the business. How would you react?

You may fear that the quality of the pizza will drop. You may worry that the quality of the wait staff will decrease. You may worry that the sale will fall through with potential buyers and the joint will shut down.

Regardless, him revealing his cards is not helpful to you. At the end of the day, it’s just a plan and revealing it can lead to more harm than good.

Revealing plans to sell a small business to your customers can lead to them going elsewhere. In doing so, that loss revenue will REDUCE the value of your business.

We recommend keeping a business sale confidential from customers until the transaction is finalized and the sale is ready to be announced.

How could employees react to the sale of a business?

Imagine that you’re attending work and the owner tells you that he’s planning on selling the business during the weekly staff meeting. How would you react?

You may fear that the new owner will downsize the operation. You may fear that the new owner will bring in a new general manager over you and stunt your ability to grow in your career. You may worry that you won’t get a raise on time.

In practice, this could lead to you interviewing at other companies in the area, bargaining hard for a raise, or becoming less engaged at work. The owner’s decision to announce his plans has not helped you in your job but instead has become a source of unnecessary worry and concern.

Revealing plans to sell a small business to all of your employees can hurt more than help. We recommend that you keep a business sale confidential from employees, except for in two scenarios.

Scenario number one is that there are key employees that the buyers will need to meet. When this is the case, we recommend reserving this step of due diligence to the very end. During this time, you can frame the conversation as meeting a potential new partner in the business.

Scenario number two is when you want to open the sale process to a few select employees who may be interested in purchasing the business. When this is the case, we recommend doing so in confidence and still running a competitive process.

How could partners react to the sale of a business?

Imagine that you’re a landlord for the business and the owner tells you that he’s planning on selling the business. How would you react?

You may worry that he’ll fail to sell the business and leave you with a vacancy. You may realize that you should ratchet up the rent, as this is your opportunity to make more money. You may divulge the information to other business owners in the area.

In all of these cases, the landlord can quickly go from being a key partner of the business to at best a risk and at most an adversary in any business sale. At Beacon, we’ve seen this more than a few times. The smarter move is to always extend your lease to have at least 36 months remaining before running a sale process. This prevents you from having to negotiate with a landlord early on.

How do you ensure prospective buyers keep the sale confidential?

Lastly, the question remains: if divulging an intended sale to customers, employees and partners is a bad idea, how do I ensure that buyers keep the sale quiet?

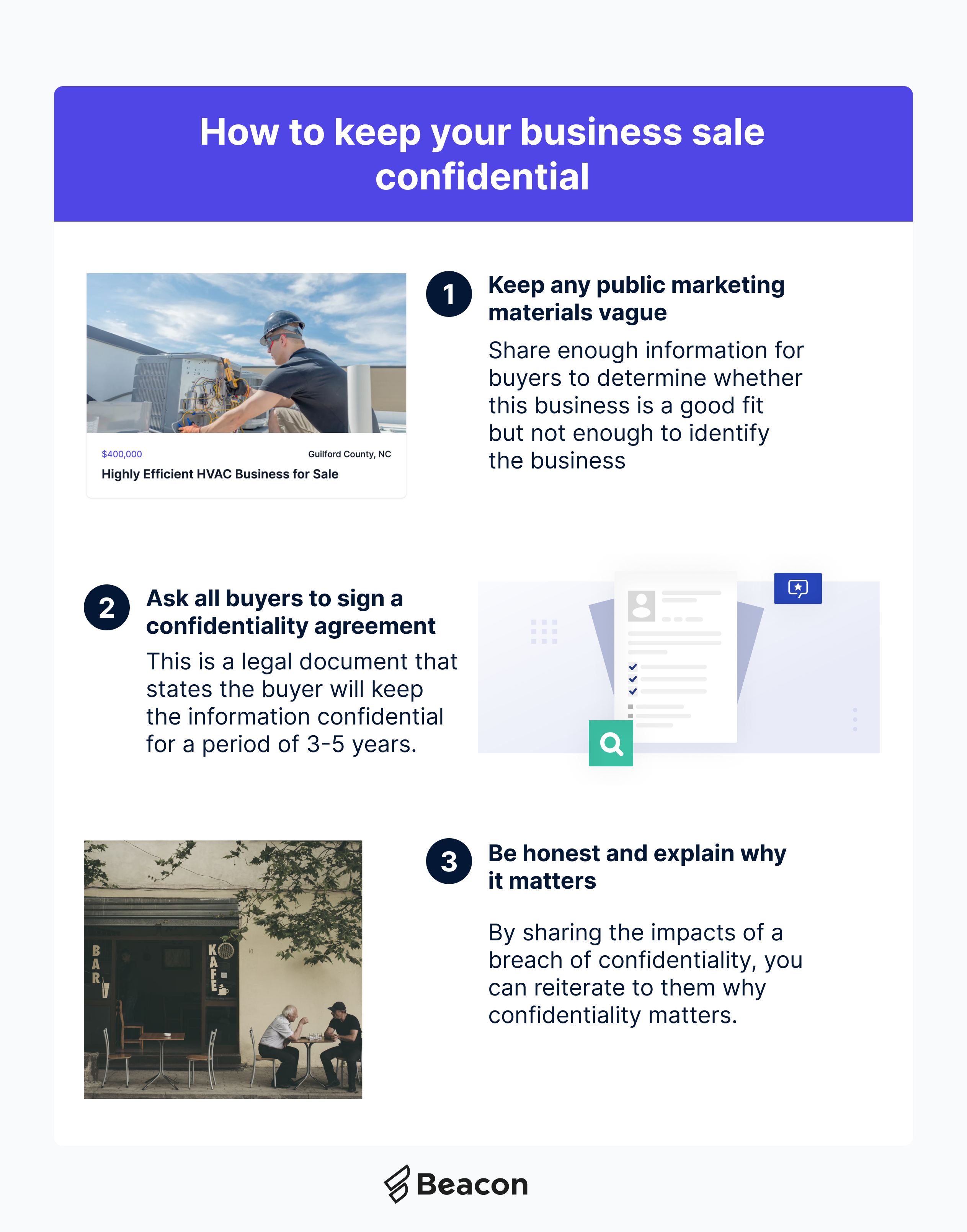

At the end of the day, there are three tried and true methods:

Keep any public marketing materials vague on the business identity. Ideally you share enough information for buyers to determine whether this business is a good fit for their goals and skills but not enough to identify the business.

Ask all buyers to sign a confidentiality agreement prior to revealing confidential information. This is a legal document that states the buyer will keep the information confidential for a period of 3-5 years. We have a template NDA in our resource center.

Be honest. Most buyers are reasonable humans at the end of the day with a passion for entrepreneurship and small businesses. By sharing the impacts of a breach of confidentiality, you can reiterate to them why confidentiality matters.

There will come a time when it's safe to announce a deal, but make sure you don't jump the gun. You've made it this far and you owe it to yourself, your employees, and customers to finish strong!

Explore your options

Get a 100% confidential and complimentary business valuation.

Will founded Beacon with the mission to help the current generation of owners to retire while enabling the next to unleash their entrepreneurial spirit. He comes from a business background having graduated from the Wharton School with a B.S. in Economics.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino