Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

There’s a certain romanticism associated with building a business from the ground up. One of the most thrilling things about conducting business in the United States is the historical precedent that you can build a trillion-dollar business from a garage or dorm room.

Even wilder still, it’s possible to do it in a lifetime. It was less than 20 years ago that Mark Zuckerberg wrote the first lines of Facebook code in his dorm room and 30 years ago that Jeff Bezos shipped the first Amazon books from a garage.

This rags to riches optimism in American business is not just rooted in recent tales of Internet whiz kids. It’s much older than that. The great industrialists of the 19th century built and spun off businesses with staggering success on the heels of the Civil War. Cornelius Vanderbilt, John D. Rockefeller, and Andrew Carnegie (with JP Morgan’s money) became dominant to the extent that they prompted the first antitrust laws in this country.

But though we’re enthralled with tales of relentless entrepreneurs who pulled themselves up by their bootstraps and, against all odds, vanquished the incumbents, these stories should come with a foreword regarding survivorship bias.

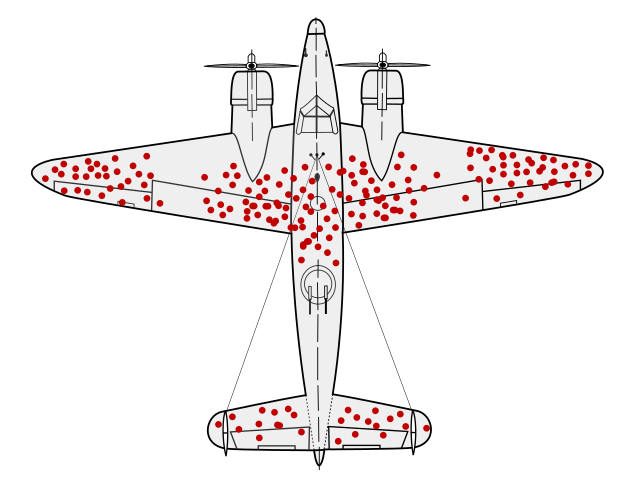

What’s survivorship bias and why does it matter? My favorite example is related to World War II bombers. The illustration below depicts the different parts of the plane that Navy engineers observed taking gunfire. Concluding that these were the parts of the plane prone to damage in combat, the recommendation was to add armor to these areas.

However, a Columbia University mathematician named Abraham Wald suggested the Navy take an entirely different approach, noting that the original damage analysis was based on a dataset of planes that survived their missions. Why didn’t the original Navy engineers observe bullet holes around the engines, nose, and tail? Because the planes that took gunfire in these places didn’t return for observation.

So here’s the foreword on survivorship bias in startups: for every underdog turned titan, there are thousands of folks who didn’t make it. The reality is starting a business means dealing with a ton of variables, many of which are out of your control. That’s why 50% of businesses fail in the first five years of existence.

These businesses all fail for a few basic reasons: failure to find employees, failure to generate revenue, and failure to turn a profit.

How do you improve your odds of survival as an entrepreneur? You buy something that is already battle-tested, has taken gunfire, and continues to fly. In other words, a business that has employees, revenue, and profit.

Buying a small business allows you to de-risk

Buying an existing business means paying to increase your chances of success. The previous owner has done a lot of work for you: he or she has hired a team of employees, acquired a Rolodex of paying customers, and maintained relationships with those customers to keep them coming back. Moreover, they’ve done it with equipment or inventory in a space that the current owner owns or leases. It’s no surprise that the success rate for existing businesses is much higher than startups – 85% of acquired businesses make it to the 5-year mark, while only 50% of startups make it to the 5-year mark.

This is not to say that buying an existing business is guaranteed smooth sailing. Running a business always comes with its challenges, but the optimistic owner will see these challenges as opportunities for growth and improvement.

Buying an existing business allows you to hit the ground running

As a new owner of an established business, you have the luxury of focusing on optimizing rather than spending a significant amount of time and energy just to get out of the blocks. The startup costs of a brand new business can range from small but numerous (such as legally setting up your operating entity) to large and expensive (like finding a long-term lease based on a lot of business assumptions).

Need equipment? Buying new means you’ll be paying top dollar in a highly inflationary environment and subject to the whims of the almighty supply chain. In short, buying a business means you’ll benefit from a running start as opposed to starting one from scratch where you’re burdened with upfront costs and endless hurdles just to make your first buck.

Buying an SMB allows you to cash flow immediately

The other great thing about buying a business is that you’re effectively acquiring an established customer base and the resulting cash flow. This cash flow allows you to buy additional inventory, equipment, and even fund research and development if you so choose. Cash flow also allows you to run payroll from day one. This means you don’t have to completely change your lifestyle and become a member of the ramen and inflatable mattress startup club.

Buying a business means you’re acquiring a business model that works and has captured some amount of market share. This, of course, is reflected in the cash flow, but there are other characteristics of existing businesses that promote customer retention and revenue growth. Brand recognition gives the business a firm footing from which to grow or defend against competitors. Often-overlooked assets like a marketing email list and social media presence provide the dry powder for a savvy owner to spark future success.

Buying is the most efficient way to hire trained employees

The hiring market in the United States continues to be tight, especially for small businesses. A US Census Bureau survey found that 23.4% of small businesses cited labor needs in August 2020. This number increased to over 40% at the end of March 2022.

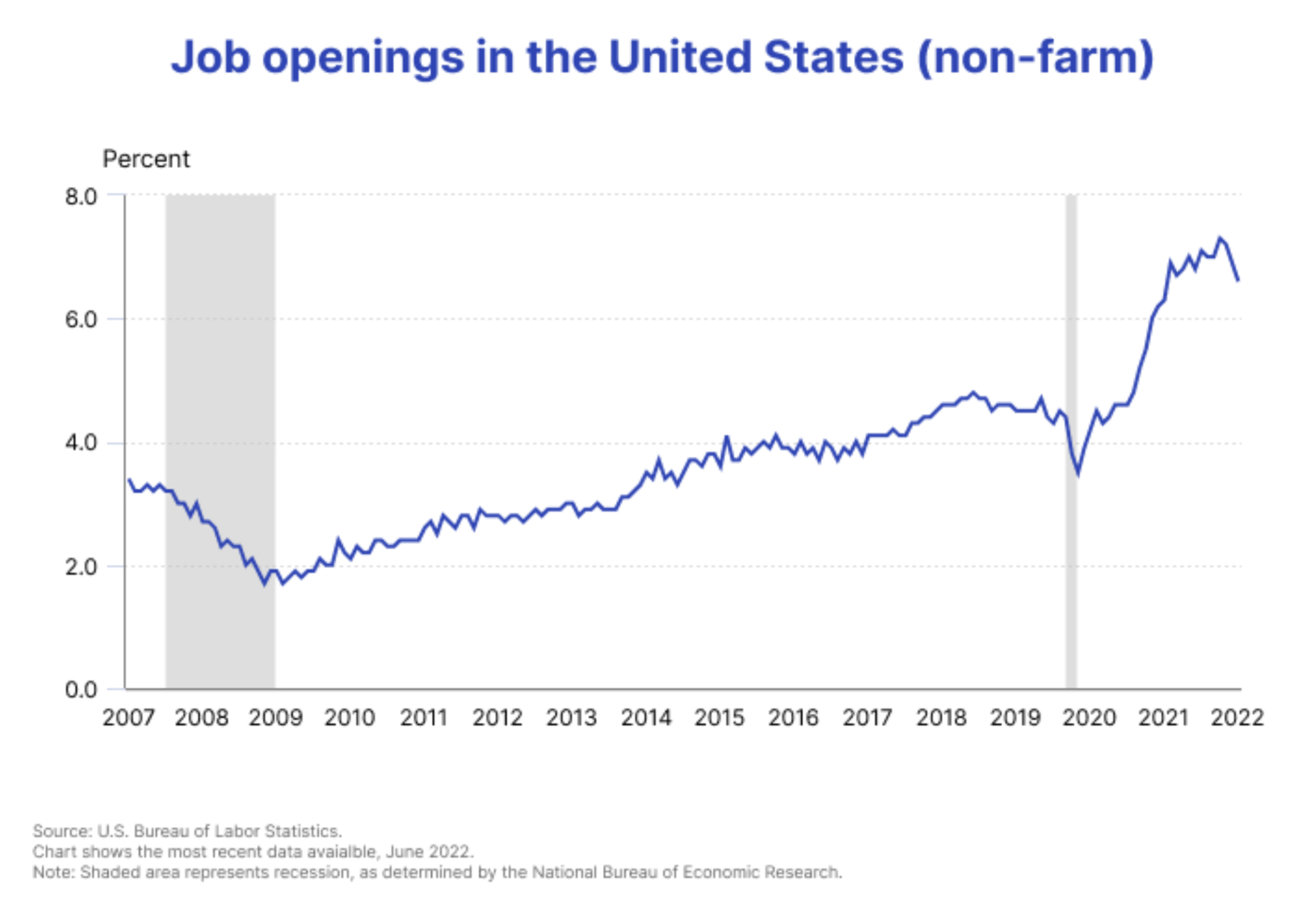

Overall, job openings in the United States continue to be historically high. The chart below shows job openings in the United States over a 15-year period based on data from the United States Bureau of Labor Statistics.

Business owners are trying to hire but are unable to do so in many cases. How do you reap the benefits of small business ownership in an environment where labor is such a huge (and time-consuming) issue? You buy a business that is already well-staffed.

So what’s the catch?

So if buying a business is so much better–it’s lower risk, faster to get up and running, immediately cash flowing, and an efficient way to hire–then what is the downside? The downside is the existing owner of the business will expect to get compensated for the value he or she is providing to the buyer of the business.

The other downside comes in the form of transition risk–whether that’s an employee who feels passed over, a customer who only wants to work with the old owner, or a landlord who sees the transition as an opportunity to capitalize. If you’re paying for the goodwill the previous owner accumulated over time, you want to make sure to retain as much of the goodwill as possible.

In addition to educating yourself on running and transitioning the new business, you’ll also want to assemble a team of advisors to help you navigate the handoff. Our new resource center is a great place to jumpstart your education.

On the bright side, small business impact on local communities is so outsized and well-recognized that the government has decided to invest in the ongoing health and proliferation of small businesses in the United States via my personal favorite federal agency, the Small Business Administration.

The SBA

The Small Business Administration (or SBA) was created in 1953 by President Dwight D. Eisenhower with the signing of the Small Business Act. The SBA’s charter is to “maintain and strengthen the nation's economy by enabling the establishment and viability of small businesses.” The agency's impact on the small business landscape in the states can be summarized by the "3 Cs": capital, contracts, and counseling.

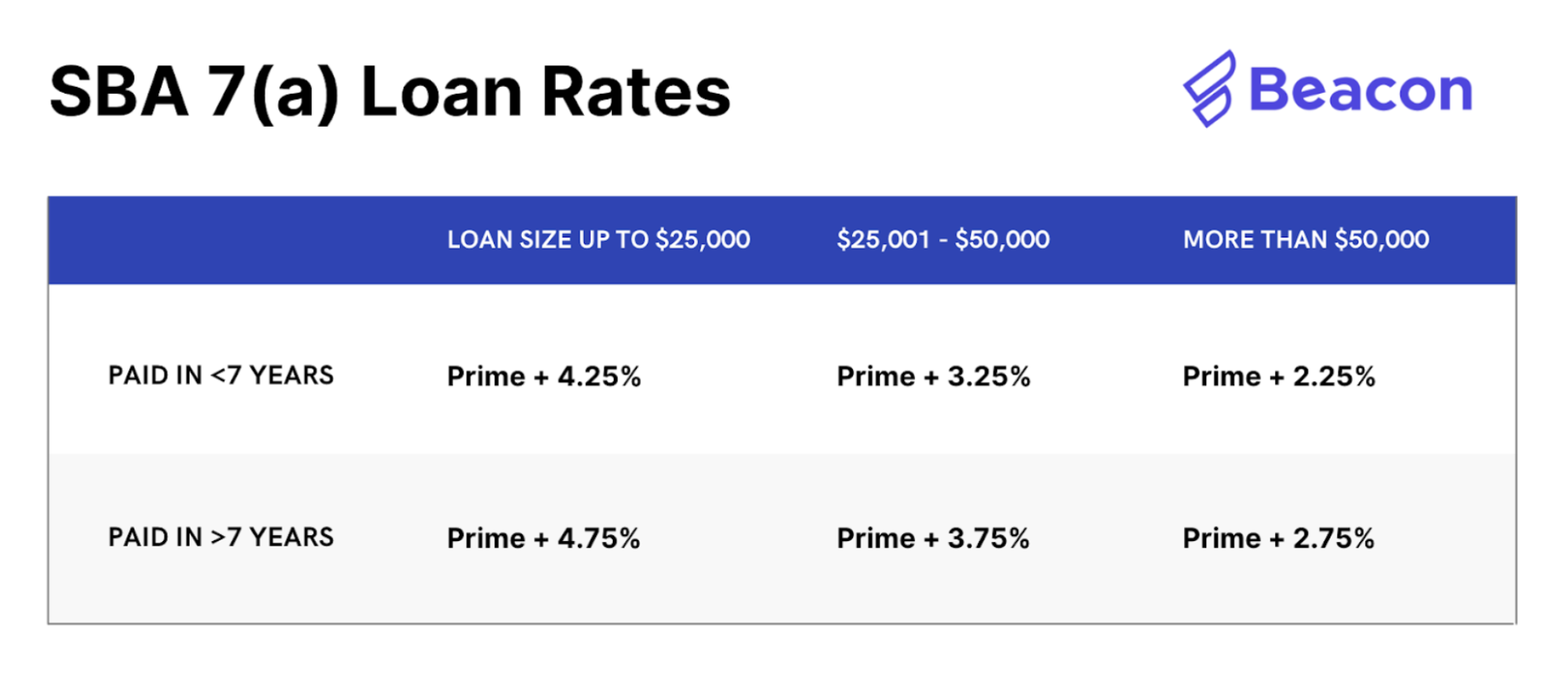

The most pertinent thing to most small business entrepreneurs is the SBA’s first “C”, capital. The SBA allows new small business owners to secure favorable loan terms, even in a high-interest rate environment. SBA loans are government-backed but provisioned via financial institutions such as banks and credit unions. The federal government serves as the guarantor, giving small business owners the backing they need to insure loans up to $5 million.

This SBA safety net makes small business owners significantly less risky, encouraging lenders to issue loans at affordable rates. SBA 7(a) loans are most commonly used for new owners to buy a business and are structured using the prime interest rate + a fixed percentage.

The nice thing about 7(a) loans is they allow entrepreneurs to put as little as 10% down, leveraging some combination of the SBA loan and seller financing to cover the rest of the cost. Check the current bank prime loan rate to get a sense of what you can expect for an SBA loan today.

Pulling it all together

There are many paths to professional success, but we’re partial to buying a small business with a proven track record. It’s much lower risk than starting from scratch and rewarding for owners and employees alike. You’ll need to come up with the capital to purchase a successful business, but Beacon (and the SBA) are here to help.

Quick sales pitch: Beacon is not just a business broker. We take on a lot of the heavy lifting well before we list a business. This includes financial due diligence in the form of tax and P&L statement analysis as well as “softer” due diligence around customer composition and employee makeup. We’ll help you find a business that suits your goals and skills as an entrepreneur, advise you through the sales process, and set you up for a successful ownership transition. In the words of Andrew Carnegie, “It marks a big step in your development when you come to realize that other people can help you do a better job than you could do alone.” Let us know how we can help!

Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

Anthony is the Marketing Lead at Beacon. He previously spent his career working for software companies in Silicon Valley but is now focused on making it easier to buy and sell Main Street businesses. Anthony studied Economics at Brown University and resides in Austin.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino