Explore your options

Get a 100% confidential and complimentary business valuation.

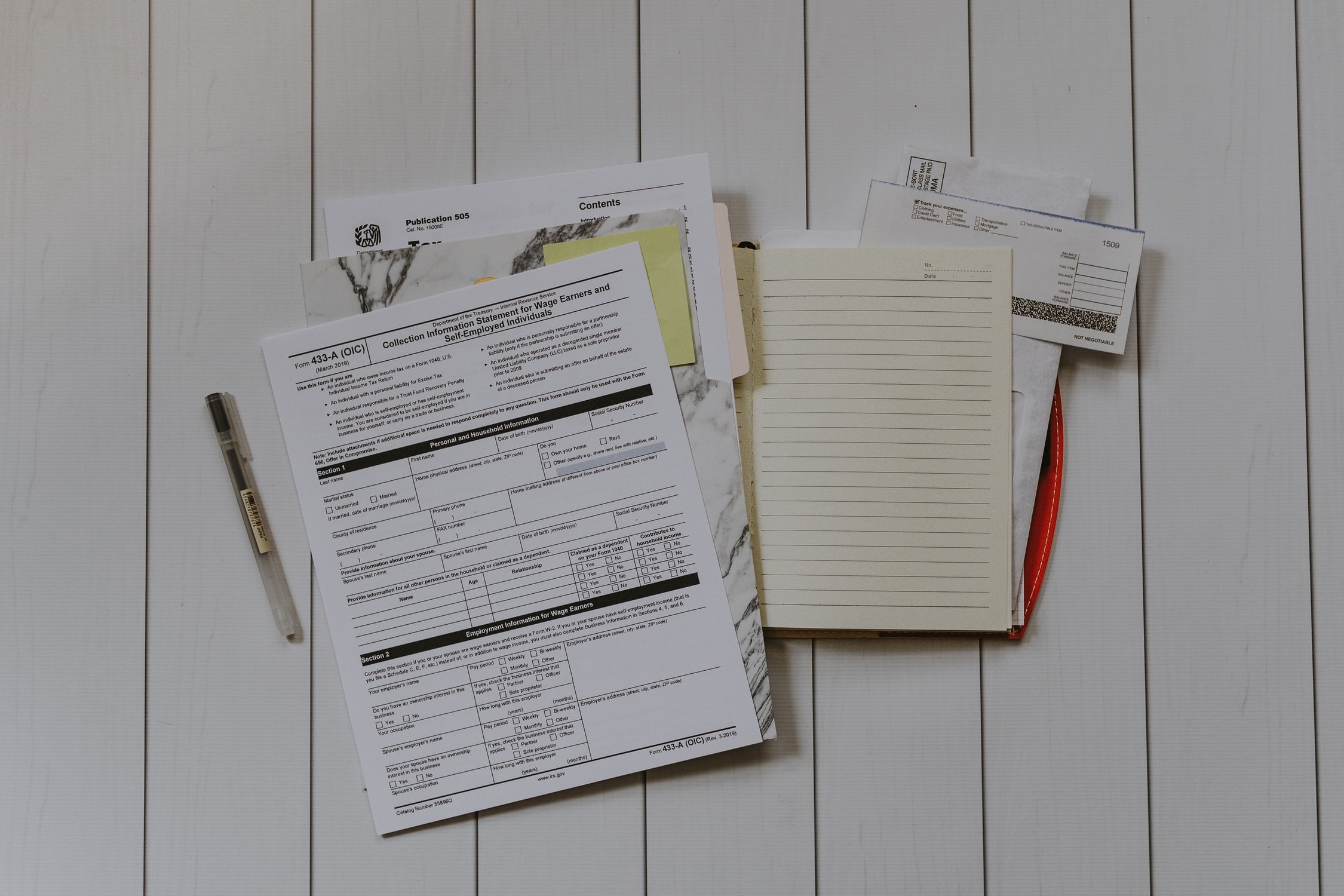

In small business acquisitions, preparation is key but often forgotten. Reverse due diligence is one of the most helpful things a small business owner can do before listing her business for sale, with or without a broker.

Reverse due diligence is the act of a business owner putting herself in the shoes of a buyer and running her own diligence process. In other words, if she were thinking about buying her own business, what are the questions she’d want to ask? What are the pieces of information she’d want to see? What are the contracts or agreements she’d want copies of?

Running through this process as an owner is useful for a few reasons.

First, the business owner may realize that she does not have certain information readily available. Perhaps, she’s been storing hard copies of her tax returns at home and she doesn’t know where they are. Or, perhaps she’s had a handshake deal with the landlord for the past decade and needs to ask for a formal agreement.

Second, the operator will have time to understand what aspects of her business may not be attractive to a buyer. For instance, perhaps the lease only has one or two years left on the current contract. This is seen as risky for a buyer, because he will be fearful that the landlord will refuse to renew the lease or will want to demand a much higher monthly rent. By understanding this prior to listing the business, the seller can go to the landlord and preemptively renew her lease for a longer duration.

Third, the owner will have fresh numbers and facts in her head. Any discrepancy between what a seller says and what the facts are is seen as a red flag by a buyer, even when the mistake was completely innocent. Having a good grasp on the business will ensure sellers never have to backtrack on their word.

When it comes to negotiating with a buyer, speed is of the essence. As Sal Acosta mentioned on our recent interview, “time kills deals.” We agree with Sal, and the number one way sellers can speed up deals is by running reverse due diligence prior to going to market.

If you're getting ready to sell your business, get started with a business valuation from us.

Explore your options

Get a 100% confidential and complimentary business valuation.

Will founded Beacon with the mission to help the current generation of owners to retire while enabling the next to unleash their entrepreneurial spirit. He comes from a business background having graduated from the Wharton School with a B.S. in Economics.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino