Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

Along with other trades like HVAC and electrical contracting, the plumbing industry has seen an explosion of M&A activity in the past decade. The industry is quite fragmented with over 122,000 individual businesses driving a total of $107B in revenue. The opportunity many buyers see is to start consolidating independent mom and pop brands into state or regional players.

When it comes time for an owner to consider what’s next, often the first question they need to answer is what their plumbing business is worth. Knowing the value of your business will help you plan for the future. Perhaps the business is worth enough to sell now, or maybe you want to invest a bit more into it so that you can get a higher price a few years down the line.

In this post, we’ll break down the process for valuing a plumbing business and share some insights that we see in the market. if you want to get a detailed valuation of your own business, please reach out. We offer confidential valuations to owners of small businesses in the U.S.

How Does a Business Valuation Work?

A business valuation involves analyzing a business’s finances and operations to determine its fair market value. There are a number of approaches to value a plumbing business: book value, market value, and a multiple of earnings. We always take a multiple of earnings approach.

Why? Two reasons. First, this is the same approach that lenders will take when funding the acquisition of your business. Second, it’s the calculus that buyers are taking: how much am I willing to pay to earn the amount of money that the current owner earns.

When performing a business valuation based on earnings, there are a few steps:

Assume cash-free, debt-free: This means that you take any cash out of the business and are responsible for paying down any outstanding debt like financing on a truck.

Calculate SDE for the past three years: SDE stands for seller’s discretionary earnings. We’ll discuss what it means and how to calculate it below.

Average the SDE across the past three years: We like to use a weighted average that weights the most recent year the most. This is especially important for businesses that were impacted by COVID and the shutdowns.

Apply a multiple to the averaged SDE: We’ll discuss multiples below as well.

As we alluded to earlier, the influx of strategic and financial buyers acquiring plumbing businesses have driven the multiples up recently. This is good for owners of plumbing businesses, as their shops are now worth more.

The result of valuing a business with a market multiple on the business’s earnings is a number or range that represents what a buyer would likely pay for the business. We discuss this in a number of our valuation guides for business owners but it’s worth repeating: a business valuation is not supposed to result in the maximum price an owner could get, nor the price that would sell the business the quickest.

The business valuation should represent what most buyers would be willing to pay for the business given the current market and the business’s recent earnings. At Beacon, we work to get the highest price possible for our clients, but for planning purposes it’s always worth starting with where the market will likely clear today.

What Is My Plumbing Business Worth?

To start, let’s discuss SDE. Above we mention applying a multiple to earnings as the common way for valuing a plumbing business. Technically, earnings as reported to the IRS would be EBITDA (net income plus interest, depreciation and amortization). However in most small businesses, EBITDA isn’t the true earning potential. EBITDA is just the earnings after the owner has run personal and discretionary expenses through the books before taxes are filed.

Seller’s discretionary earnings looks at the true earnings power by adding back unnecessary expenses. Oftentimes, small business owners run a number of personal expenses through the business: healthcare for the family, cell phone bills, personal vehicle purchases, etc. Those expenses count towards SDE.

A good rule of thumb for a “discretionary” expense is whether a new buyer would need to keep paying it in order to generate the revenue. Payments on a 2021 Chevrolet Suburban used by the owner’s spouse? Nope, not needed. Bonuses to employees that they have grown to expect? Yep, needed to retain employees.

To calculate SDE, we add up the following:

Net Income (reported to the IRS on the tax return)

Interest

Depreciation

Amortization

Owner Compensation (e.g., salary of the owner, healthcare and retirement benefits)

Discretionary Expenses (e.g., family members on payroll who aren’t actively working)

The best practice is to calculate the SDE for each of the past three years so that we can calculate a weighted average.

Once you’ve come to a number for each year, you’ll want to adjust it so that it represents the SDE a new owner would have. Here are some common adjustments we see:

Rent: If you own the property through another entity and do not charge yourself rent, you’ll need to factor in what rent you would charge the buyer of the business. If you own property but overcharge the business rent, you’ll need to adjust the SDE to account for how much you’d really charge.

Personal Vehicles: If you have bought personal vehicles through the business, you need to remove the interest and insurance payments from the expenses for the relevant years.

Family Members: If you have a few family members on payroll that would leave when you sell, you need to make sure that their work is represented correctly in your SDE. For instance, if your son draws a full salary but only works a day per week, you’ll need to remove his salary from the expenses but add back in the hourly amount you’d need to pay for someone to cover his day per week of current involvement.

How Do I Account for SDE When My Business Has Been Improving?

Now that we have a number for Seller’s Discretionary Earnings and we’ve adjusted it for a new buyer, we need to come up with an average that represents future earnings.

There are a number of ways to calculate a fair average of SDE across the years. At Beacon, we use a somewhat complicated formula. If you’re doing a valuation at home, we recommend that you weight the most recent year 50%, the second most recent year 37.5% and the third most recent year 12.5%.

For instance, if you had SDE of $400K, $425K, and $350K in 2022, 2021, and 2020, you would do the following: $400K x 50% ($200K) + $425K x 37.5% ($159.4K) + $350K x 12.5% ($43.7K). Adding those up would yield $403.1K. This would be your weighted average SDE.

The reason for weighting 2022 the most is that it’s the most representative of the future. This is especially true for the trades where some states when into mandatory lock down for a while, causing hardship for business owners.

Valuation Multiples for Plumbing Businesses: What Multiple Should I Use?

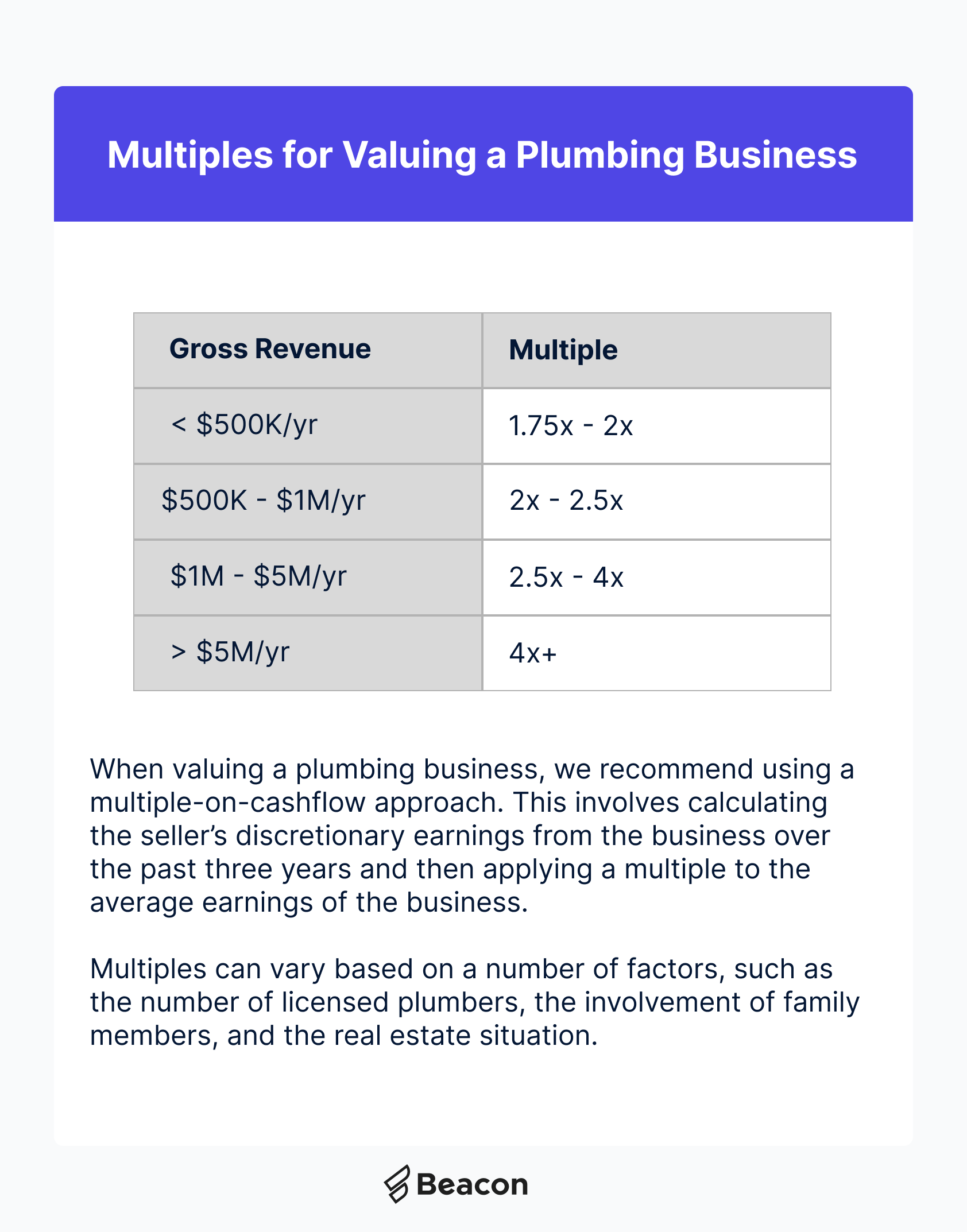

Once you’ve calculated your weighted average SDE, the last step is to apply a multiple to your SDE. A number of factors affect your multiple, but the main one is the size of the business.

Below is a chart of multiples based on the revenue of the business. However, it’s worth noting that there are a number of factors that can increase or decrease your multiple.

Using the example of a $403.1K SDE above and revenues of ~$2M, the value of that plumbing business would be between $1M and $1.6M.

Factors That Impact the Multiple of Your Plumbing Business

Licensing: Ensure that your plumbing business has the appropriate state licenses. We’ve seen cases where owners are not properly licensed and insured. We’ve seen other cases where owners claim to be below the per-job-revenue amount for licensing in California. The bottom line is that either situation introduces risk to a new owner. Buyers with bigger pockets will stay away from improperly licensed plumbing businesses as they do not want to get in trouble with regulators.

Plumbers & Crews: Plumbing companies with seasoned plumbers who have been with the business for more than three years see higher multiples. Why? A new buyer knows that he or she can rely on the employees and that the employees can help minimize risk during an ownership transition.

Estimators: Having an on-staff W-2 estimator is a huge plus. Estimating work is hard and is part science, part art. By having an estimator on staff, a buyer doesn’t need to worry about quickly learning the art from the owner.

Owner Involvement: Smaller companies where the owner is involved in bids and project work are valued at lower multiples. Why? The owner’s day-to-day work will need to be replaced by the new buyer, a new hire, or someone internally. The more the owner does day-to-day, the harder it will be to successfully transition him out.

How Do I Maximize the Price of My Plumbing Business?

There are a number of ways to increase the value of a plumbing business. For advice specific to your business, we recommend getting a complimentary valuation and speaking to someone on our team who specializes in the plumbing industry.

Aside from that, there are a few pointers for increasing the value of your business:

Clean up your books: At the end of the day, income reported to the government is valued higher than “discretionary expenses” that a buyer won’t have to pay. Why? It’s easy to prove income reported to the government. It’s hard to prove that a phone bill is really for your family member who doesn’t work in the business.

Hire an in-house estimator: By hiring someone who focuses on making bids for jobs, you offload that responsibility from you as the owner. This decreases the risk of any ownership transition, as the new owner will not have to come up to speed to how you manage bids before you ride off into the sunset.

Get the back office organized: Ensure you have good processes for managing accounts receivable, routing crews, and managing the books. Sometimes owners put this in the back seat, only for it to bite them when considering a sale. Most buyers will want to do some diligencing of your operations. The more organized you are, the better the outcome.

Licensing and Permitting: Most states require licensing both of the staff and sometimes of the entity itself. Make sure that you’re up to date with any licenses or permits required for your plumbing business.

Invest in tooling: New software systems like Service Titan help to streamline your operations and make it easy for a buyer to come into the shop and get off to the races on your business after the deal closes.

Who Should I Consult for a Business Valuation?

At Beacon, we focus on working with owners of “main street” businesses. Businesses in this segment typically have between $500K and $12-15M of revenue.

If you own a plumbing business that earns revenue between $500K and $15M, we will happily do a complimentary valuation for you. Our valuations take approximately a week to complete and are completely confidential.

As part of our valuation, you will be matched with a business broker who has experience with plumbing businesses. If this sounds helpful, get started with a request here.

If you own a plumbing business larger than this size, we recommend that you consult an appraiser such as Peak Business Valuation who specializes in lower middle market businesses.

Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

Sam is an exit planning expert, combining years of experience working with small business owners with extensive knowledge of traditional and SBA financing.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino