Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

Conducting a business valuation is a valuable exercise at any stage in the small business lifecycle. If you are thinking of selling your business, conducting a fair market valuation can help you understand what a buyer is likely willing to pay to acquire your business. Even if you are not interested in selling your business in the short-term, conducting a valuation can help you assess the financial health of your business and implement changes that will increase the value of your business in the future.

Small Business Valuations Explained

The fair market value of a business, as defined by the Internal Revenue Service, is the price that would be agreed on between a willing buyer and willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts. Arriving at a fair-market value for a small business is both an art and a science. It requires a deep understanding of a business’ operations and cash flows. Additionally, a valuation must take into account macroeconomic factors of the industry in which the business operates (e.g. labor shortages making it hard to grow..

If you are planning to sell your business and are interested in a complementary valuation, please let us know.

How Small Businesses Are Valued: 3 Common Methods

There are three common methods to small business valuation: Income-based, Asset-based, and Market-based. Each of these methods takes a different approach to valuation, whether it is based on the cash flows that a business generates, the assets on its balance sheet, or the purchase price of companies in the same industry. It’s important to remember that there is no “correct” method, as each method has its advantages and drawbacks.

Income Method

The Income valuation method, also known as the Earnings method, considers a business’ ability to generate profits and cash flow in the future. You may have heard about EBITDA, or earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure of the cash flows that a business generates from its core operations. While EBITDA is used in valuation assessments for middle-market business, it is not commonly used for small businesses because it ignores the non-operating expenses that small business owners often run through their businesses. This could include discretionary travel, vehicle expenses, or social club memberships. Buyers of smaller businesses are instead focused on the cash flow they can expect to receive as the owner-operator of the business, known as Seller’s Discretionary Earnings, or SDE.

Calculating Seller’s Discretionary Earnings

Calculating SDE is a 3 step process.

Starting with pre-tax earnings, add back interest, depreciation and other non-cash expenses.

Normalize earnings by adding back one-time or non-recurring expenses and subtracting one-time revenues.

Add back owner benefits. This includes the owner’s salary, health insurance, and any other non-business expenses like a personal car or travel expenses.

To learn more about SDE and learn how to calculate it for your business, please read our post on Understanding Seller's Discretionary Earnings.

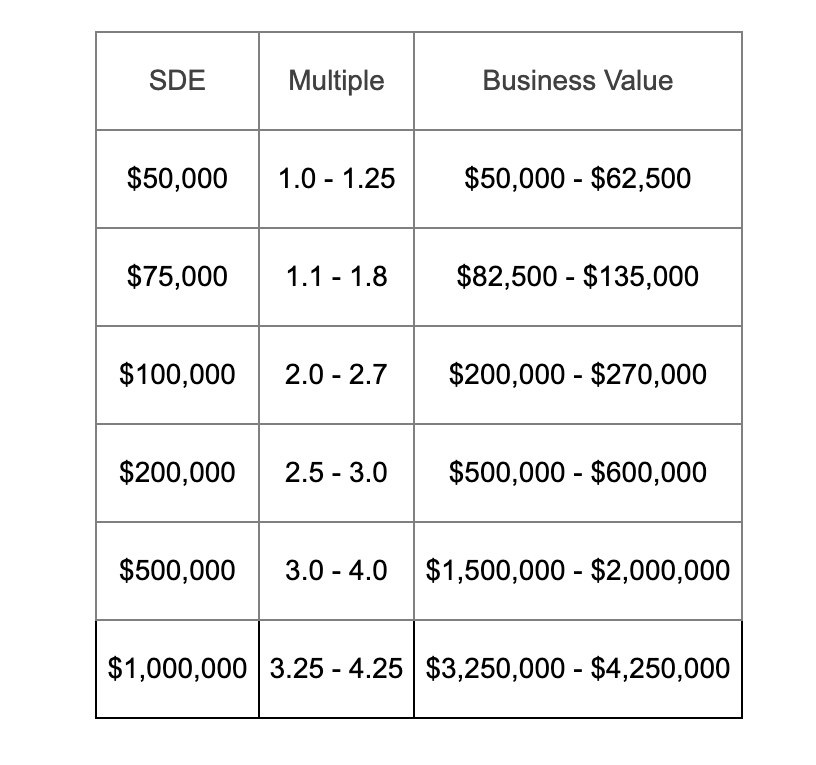

Once SDE is calculated, a multiple is applied to SDE to arrive at a valuation. This multiple is meant to represent what similar types of businesses are selling for in the market and is influenced by a variety of factors, like the industry, size of the business, and the amount of time the business has operated.

What Determines the SDE Multiple?

The multiple on SDE is said to be an implied multiple. This multiple isn’t found anywhere on the business’ financial statements or business plan. It is implied by a number of factors related to the business, like it’s industry, size, or profitability.

Industry

The most important factor in determining the SDE multiple for a small business is its industry. The industry that a business operates in is a key determinant of that business’ future growth prospects. For example, an excavation business’ growth prospects are limited by the amount of capital they have to invest in equipment. In other words, the ability of an excavation business to increase the number of contracts that it fulfills is restricted by the equipment they own or have access to. Additionally, an excavation project is incredibly time and capital intensive. Often, a single job can take months or years to finish. A small excavation business may be reliant on 2 or 3 large contracts for the vast majority of its business. For these reasons, future growth prospects and high customer concentration, the SDE multiple for heavy construction businesses is usually between 1.5 to 2.5 times SDE.

On the other hand, small eCommerce businesses typically trade at higher multiples, between 4 to 6 times SDE. The eCommerce marketplace is expected to grow considerably and with platforms like Shopify, savvy small business owners can quickly and efficiently scale their operations. Additionally, eCommerce businesses often have much richer datasets for their operations, by the nature of the business existing exclusively on the internet. This can give a potential buyer much greater peace of mind when performing diligence, as they have quick access to all facets of the business.

The bottom line here is that industry is the primary determinant of the SDE multiple. The industry that a business operates within is illustrative of the prospects for future growth, profitability, customer concentration, and stability of the business. These are all crucial factors that entrepreneurs and prospective buyers will consider when they are evaluating your business.

Business Size

Larger businesses command higher SDE multiples for several reasons. Larger businesses are better able to generate cash from operations, which means that a new owner can either reinvest that cash into the business, use the cash to service debt obligations (larger businesses are able to secure loans at lower interest rates), or use that cash to reward themselves and their employees with year-end bonuses.

Apart from the financial reasons listed above, larger businesses are more desirable to aspiring entrepreneurs because the current owner has proven they can successfully extract themselves from the business’ core operations. Buyers do not want to worry about a mass customer or employee exodus if the owner leaves.

Other Factors

Apart from industry and business size, there are several other factors that influence the multiple that a buyer will be willing to pay for your business. This can include:

Consistent record of historical growth and profitability

Desirable location

Clean record and bookkeeping

Highly favorable lease terms or ownership of real property

A long (10+ year) business history and tenured employees

Low customer concentration

Up-to-date and thorough maintenance records on capital equipment

Favorable seller financing (See our blog post on Seller Financing)

Discounted Cash Flow Analysis

Another income-based valuation method is a Discounted Cash Flow, or DCF. You’ve probably heard of this method as it’s commonly used to value larger enterprises. A DCF calculates the intrinsic value of a business by discounting the business’ future cash flows using a discount rate.

A Discounted Cash Flow tells us how much a business’ future cash flows are worth in today’s dollars. DCFs are not commonly used for small business valuations, and for good reason. Small businesses often face far greater uncertainty in their cash flows, which makes forecasting cash flows 5-10 years into the future a difficult process. Owner-operators of small businesses often have shorter time horizons as well and often are focused more on the businesses operating smoothly than on long-term growth. For these reasons, most small business valuations do not typically involve conducting a DCF analysis.

Asset Method

Unlike the Income method, the Asset method (or Adjusted Net Asset Method) does not require digging through your finances or making any assumptions about the growth of your business. The Adjusted Net Asset method assigns value to a business based on the market value of its assets less the market value of its liabilities. Assets include the market value tangible and intangible assets. Tangible assets include FF&E (Furniture, Fixtures, and Equipment), any real estate owned by the business, inventory, and cash on hand. Intangible assets include customer lists, brand recognition, or online reputation Liabilities will include any accounts payable, short-term debt, business loans, or accrued expenses.

The Adjusted Net Asset method does not fully represent the value of business that is intended to be sold as a going concern. Going concern is a term that refers to the ability of a company to continue operating indefinitely. If a business is sold as a going concern, it has the resources in place to continue generating cash flow to cover all expenses and service outstanding liabilities.

This means that the Adjusted Net Asset method is best used for creating the price floor for a business. If a business were to close up shop and liquidate its assets, the Adjusted Net Asset method could be used to determine what proceeds the owner could expect to receive.

Market Method

Of the three valuation methods, the Market method is the most reliable. Conducting a Market-based valuation begins with researching the purchases of comparable businesses, or those that operate in the same industry and across the same geography. Once a sample size of 5-10 comparable businesses has been obtained, then it’s important to assess your company against those in the sample. Here are some questions to consider when you are comparing your company to other companies in the same industry that were recently sold:

Does your business target the same customer base or employ the same revenue model?

In the case of a landscaping business, this could be the split between commercial revenues and residential revenues or for an auto shop, the split between fleet repair revenues versus personally owned vehicle repair revenues.

Is your business larger or more profitable than the business in the sample?

How many employees (full-time, part-time or contract) does your business have compared to the sample?

Using recently sold businesses as the basis for your valuation is especially useful in that it takes into account the market’s appetite for similar businesses. The Market method will provide the most realistic purchase price for your business because it represents what an interested buyer would be willing to pay for your business today.

Finding data on similar businesses is not always easy. Using the Market method can be difficult for businesses located in more remote geographies or those that have unique business models. If that’s the case for your business, don’t worry. Having a dataset of 3 or 4 sold businesses that are of a similar size and operate in the same industry (even if they are in a different area) is sufficient to perform a Market analysis. Two good resources for finding data are PeerComps and BizComps.

So Which Valuation Method Should I Use?

All of them! There is no “best” valuation method. Each of them has their benefits and drawbacks. At Beacon, we will use all three methods to determine the value of a small business, but prioritize the Market valuation method because it’s the best proxy for what a buyer is willing to pay.

Valuation Amount versus Valuation Range

A common misconception is that the output of a valuation is an amount. While it’s true that on BizBuySell and other listing sites only an amount is advertised, the true output of a business valuation is a range (often 10-20%). This range takes into account the universe of buyers for a particular business.

Let’s use Beacon Auto Shop as an example. If an auto shop franchise, a strategic buyer, is interested in expanding, they are likely to pay a premium for Beacon Auto Shop versus a local entrepreneur, a financial buyer. This is because of the synergies that the strategic buyer can expect to take advantage of by owning Beacon Auto Shop. For example, the auto shop franchise can use their existing partnerships with parts suppliers to lower Beacon Auto Shop’s parts costs and make them more competitive in the local marketplace. This is just one of many examples of synergies that would make Beacon Auto Shop more attractive to an auto shop franchise (a strategic buyer) than to a local entrepreneur (a financial buyer).

There is no one true value of a small business. All three valuation methods should be used to create a valuation range that would be acceptable to an interested buyer and to the seller. Each small business presents a buyer with a unique set of challenges and opportunities. At the end of the day, the “correct” price is the market clearing price, or fair market value.

At Beacon, we pay most attention to the Income and Market-based methods, as these allow us to most effectively value the business at a fair price that will capture the attention of the market while adequately capturing the full value of the business as a going concern. It’s worth noting that buyers typically run these same Income and Market-based analyses during the diligence process. Lastly, these two valuation methods are highly defensible, providing leverage to the seller in price negotiations.

Improving Your Small Business Valuation

Understanding the valuation range for your business enables you to make key decisions about the future of your business. Even if you are not ready to sell and are just interested in what your business is worth, conducting a valuation for your businesses and understanding the methodology will reveal the ways that you can increase the value of your business and make it more attractive to buyers when you are ready to sell.

There are three ways to increase your business’ valuation, increase your revenues, reduce your costs, or improve stability. With a valuation in hand, it will be clear which aspects of your business are either a drain on resources or a source of untapped potential.

For example, you may look through your balance sheet and find that the working capital in the business far exceeds what is necessary for day-to-day operations. You can put your excess cash to work by investing in new equipment, new marketing systems, or by giving raises to high-performing employees.

Another common way the small businesses owners are able to increase their business value is by focusing on lucrative business segments. For instance, while engine and transmission work can often lead to large payouts in the form of parts and labor, these services are extremely time and labor intensive. Auto shops looking to increase their efficiency can instead focus on maintenance and light repair work, which is more profitable and can lead to greater customer satisfaction.

There are also ways to demonstrate your business’ value to potential buyers that don’t rely on financial analysis. For instance, if you can show that the people and processes currently in place will keep the business running smoothly after you leave, buyers may be more willing to agree to a higher valuation. Additionally, you can entice buyers by demonstrating that your employees value their work and would be able to take on new responsibilities after you leave. Low employee turnover will save the business money, and responsible employees will make the transition to new management seamless.

Conducting a valuation is important at any stage in a business’ life cycle. Even if you aren’t ready to sell, understanding your business’ valuation and the methodology behind it will help you identify your business’s strengths and weaknesses.

Get a free valuation from Beacon here.

Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

Will is responsible for helping sellers market their businesses to prospective buyers and providing hands-on support from offer to close. Using his background in mergers and acquisitions at Wells Fargo, he drives value and provides clients with the necessary resources, best practices and advice for a successful sale of their business.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino