Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

When entrepreneurs acquire a business through Beacon, they’re looking for more than a job. They’re looking to treat their business as an investment.

Many prospective buyers struggle to analyze SMBs. Historically, they may have invested in real estate or the stock market. But, few have invested in a small business before.

In both the real estate and stock markets, there are a number of ways to measure the potential performance of an investment: cap rate, NOI, internal rate of return (IRR), sharpe ratio, P/E.

While some of those can be used to evaluate an SMB, there are a few that we see quite often in the “Main Street” segment: SDE multiple, cash-on-cash returns, payback period, and multiple of invested capital (MOIC).

In this post, we’ll dive into how multiple of invested capital can be used to measure and compare SMBs as an investment.

What is a multiple of invested capital?

A multiple of invested capital (MOIC) is a common metric used to calculate an investor’s return on investment. It takes into account two things: (1) the price of the investment, and (2) the value of the investment. Unlike IRR, time is not a component of this metric.

To calculate the multiple of invested capital from an SMB acquisition, you can take the total value realized from the acquisition and divide it by the total dollar amount you invested into the acquisition.

How do you calculate the total value realized from the acquisition?

It’s easiest to think of the total value realized by looking backwards. Imagine that you’re about to sell the business a decade or two down the line. To calculate the total value realized, you’d sum all of the earnings you drew out of the business with the price you sold the business. Together, this would be the total value realized over the course of your ownership of the business.

When looking at a prospective acquisition, it’s hard to speculate about your exit price, or the price at which you sell the business down-the-line.

Because of this, we recommend that buyers introduce time into the MOIC calculation. To keep things simple, we recommend that buyers sum all of the earnings they would draw out of the business over the first 5 years. The best measure of earnings in an SMB is free cash flow (FCF). Free cash flow is the earnings the business generates after paying expenses and debt obligations.

Should salary be included in the earnings?

A common question asked is whether an owner-operator buyer should include his or her salary when calculating the total value realized from the acquisition.

We recommend that buyers not include the “operator” salary of the business. Instead, they should budget a reasonable amount of money they plan to allot towards their salary, if they were to own and operate the business. Any money earned in excess of this salary, other expenses, and debt payments would count towards the total value realized.

Why do we recommend excluding salary from total value realized? We want to help buyers compare businesses in an apples-to-apples fashion. Some businesses may require an owner-operator, while others may not. Some buyers may initially operate the business but plan to phase out as they hire a GM. Nearly all buyers want to acquire something more than a job.

By excluding salary from calculating realized value, buyers can focus on measuring value received in excess of just another salary.

What is included in the total dollar amount invested?

When focusing on the denominator, it’s important to only calculate the money a buyer invested into the business. In other words, what equity did the buyer inject? This is different from the acquisition price.

If a business is acquired for $1M with an SBA loan and the buyer put 10% down, then the total dollar amount invested was $100,000.

How do you interpret MOIC?

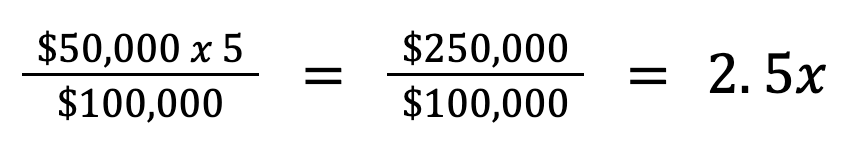

Once you have the total value realized over a five year span as well as the total dollar amount invested, you can calculate a 5-year multiple of invested capital by taking the value realized and dividing it by the amount invested.

For example, if you believe the business will generate $50,000 of free cash flow after paying expenses, including a salary for an operator (whether that’s you or a GM) and debt obligations, then using the example above your multiple on invested capital would be 2.5X.

What is a good multiple of invested capital?

Given the effort involved in acquiring and managing a small business, we recommend that buyers seek out acquisition opportunities that have at least a 2x MOIC over a five year period.

We’ve found that to be a strong benchmark for SMBs. A 2x MOIC over a five year period roughly correlates to a 15% IRR for those coming from the real estate world.

How do you increase returns on an SMB acquisition?

In order to increase returns on an SMB acquisition, there are ultimately two things that a buyer can do: increase the total value realized or decrease the total dollar amount invested.

Put bluntly, a buyer can approximate aggressive cost cuts or top-line growth to help increase the total value realized, or a buyer can negotiate more debt or a lower price.

Considering buying a small business?

If you’re considering buying a small business, sign up for our buyer alerts. We calculate a number of various metrics for each of our listings to help bring transparency and trust to the buying experience.

Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

If you're interested in acquiring a Main Street business, Katie is your go-to person. Katie hails from Kansas City originally and majored in Art History at the University of Kansas. In her free time, she enjoys climbing, paddleboarding, and cooking.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino