Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

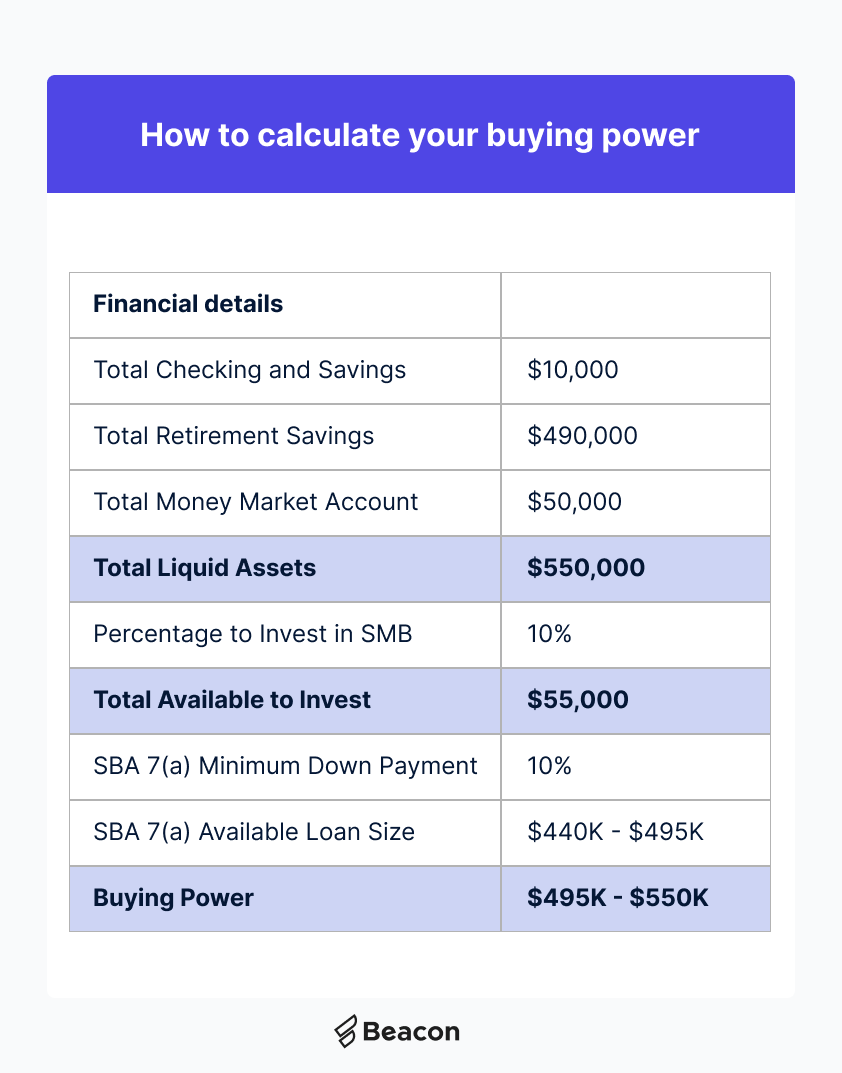

Buying a business is exciting, especially as you explore different industries and develop a playbook for how you want to grow and expand your operation. But how do you determine your budget? To set realistic expectations, consider your personal finances, borrowing options and the total costs of an acquisition.

1. Estimate your liquid assets

Regardless of whether you use SBA financing, a seller note, or purchase a business outright in cash, you’ll need to have enough liquid assets to meaningfully contribute to the acquisition.

Checking and Savings

The first type of liquid assets is cash kept in a checking or savings account. These are typically the most liquid but most buyers do not keep a majority of their assets in checking and savings accounts.

Retirement Savings

The second type of liquid assets is retirement savings in a 401(k) or IRA. Most buyers do not count these when determining their budget, but there are a number of ways to leverage retirement savings into a business acquisition.

Money Market Assets

The third type of liquid assets is cash kept in a money market account or invested into stocks and bonds. These assets can be sold off to use towards a down payment on a business.

After you total your liquid assets, you’ll want to come up with a number that you’re comfortable putting into a business acquisition. While a business acquisition is an investment, similar to how you may treat your money market account, it comes with higher risk and higher returns. We recommend working with a financial advisor to determine how much you can comfortably use to buy a business.

2. Check your credit history

Once you have a sense of how much money you have to invest in a business acquisition as a down payment, the next step is to understand your credit history. Based on your credit history, you can qualify for various types of debt to increase your buying power.

For those with credit scores above 620, the SBA 7(a) loan program can help you get up to another 9x of buying power on top of your down payment.

For those with worse or no credit, we recommend researching local and state loan programs designed to stimulate the small business economy. Often there are CDFIs or other groups that provide loans which can be used for business acquisitions.

3. Get pre-approved for a business acquisition loan

If it looks like the SBA loan program would be a good fit for you, we recommend that you work with a lender such as Fountainhead, Huntington Bank or LiveOak to get pre-approved.

Pre-approval will give you confidence in the size of business you can acquire while providing you with proof of pre-approval to show to business owners during negotiations.

4. Learn more about 401(k) financing options

If you want to use your 401(k) savings as part of your down payment for a business acquisition, you can use the ROBS program. ROBS stands for Rollover as Business Start-up (ROBS).

According to the IRS, individuals can roll over their existing retirement funds to a ROBS plan in a tax-free transaction. The ROBS plan then can use these rollover assets to purchase the stock of the new C Corporation business.

We recommend that buyers work with Guidant Financial to explore using ROBS for a business acquisition.

5. Research upfront costs

When determining your budget for a business acquisition, it’s important to remember that the down payment is not the only cost associated with acquiring a business. There are typically three different types of additional costs.

Transaction Fees, Included in Loan

There are some upfront costs which can be included in the loan amount for a business acquisition. A common example of this is the SBA guarantee fee. The purpose of this fee is to cover the government’s cost when a borrower defaults on a loan, as the government guarantees a portion of the loan to the bank that extends it. This fee can range from 0% to 3.5% of the total loan size.

Other common fees include an SBA loan packaging fee, used to organize loan docs and improve approval chances, an SBA loan broker fee, which is charged if you use a broker to facilitate the loan, and other SBA loan closing costs.

Transaction Fees, Excluded in Loan

Some fees cannot be rolled into the loan, and the buyer will be responsible for the entire amount upfront. Examples include business valuations, appraisal fees, and attorney costs.

Setup Costs

Lastly, most buyers will need to do a fair bit of setup work prior to the transaction closing. At Beacon, we streamline the process for buyers. It includes creating a new business entity, setting up a business bank account, purchasing business insurance, and other miscellaneous tasks.

6. Calculate the budget for ownership costs

Apart from the down payment and transaction fees, the last area that a buyer should budget for is life as the new owner. While some buyers may take out a working capital line of credit as part of the transaction, other buyers will want to use their own savings as working capital.

Working capital is the capital used in day-to-day operations. For instance, if you owe your suppliers 15 days after receiving supplies (e.g., NET-15), but you get paid by your clients 30 days after performing work, you’d need capital budgeted to help smooth out your finances. In other words, working capital is what would help you pay suppliers before you get paid by customers.

By chatting with the previous owner of the business, buyers can get a fair sense of how much working capital they should have in the bank when they take over the business.

Conclusion

Unlike the real estate market, the market for buying a business can be confusing and opaque. At Beacon, we’re determined to bring transparency and efficiency to the process of buying a business.

If you have questions about your buying power and how to set your budget, reach out to us today and we’d be happy to chat.

Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

If you're interested in acquiring a Main Street business, Katie is your go-to person. Katie hails from Kansas City originally and majored in Art History at the University of Kansas. In her free time, she enjoys climbing, paddleboarding, and cooking.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino