Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

When looking for small business loans or credit lines, owners may come across Community Development Financial Institutions (CDFIs). These private institutions are dedicated to helping increase access to financing in underserved communities. Each state has a number of CDFIs who disperse billions of dollars of capital to consumers, small businesses and real estate projects.

Why do Community Development Financial Institutions exist?

Community Development Financial Institutions were kick started in 1994 through the Riegle Community Development and Regulatory Improvement Act passed that year. This act set up the CDFI Fund, which formally certifies a financial institution as a CDFI and makes loans to individual CDFIs, who can then go on and lend this money directly to the community members and businesses who need it the most. While some non-profits and community banks were already focused on serving their communities prior to the act, the creation of the Fund helped to put more resources and recognition behind these organizations.

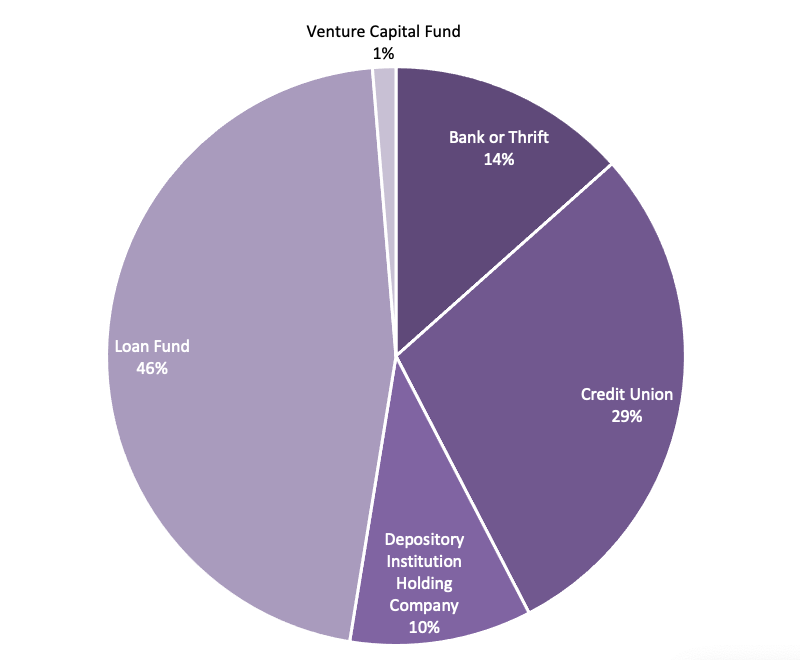

Although any given CDFI may be non-profit lender, a credit union, or a bank, they are common in that they all share a primary mission to promote community development through financing and development services. The process for being certified is laid out on the [CDFI Fund’s website](https://www.cdfifund.gov/programs-training/certification/cdfi). As of 2021, there are over 1,2000 CDFIs. They are spread out over all 50 states, D.C., Guam and Puerto Rico.

How does a Community Development Financial Institution acquire funding?

Each CDFI draws upon a number of funding mechanisms, ranging from the CDFI Fund at the federal level to various state and local grants designed for community members and business owners.

For instance in Pennsylvania, the Pennsylvania Community Development Bank Loan Program provides debt financing for CDFIs. This program doles out $250,000 to $5,000,000 in capital for CDFIs to lend themselves, so long as they meet certain criteria such as being an accredited CDFI, focusing on economic development and job creation, and having a minimum two years lending experience.

Another program run through the Pennsylvania state government is the Business Opportunities Fund. This fund focuses on installment loans and lines of credit for minority-, veteran- and women-owned small businesses through partnerships with CDFIs. These CDFIs are ultimately responsible for vetting and lending to the recipients and act as the stewards of the state’s resources.

For CDFIs who act as credit unions, they may use deposits at their institutions as an additional source of capital to lend.

When is a CDFI most pertinent?

CDFIs are intended for individuals and businesses that struggle to get access to financing. In line with that mission, nearly 75% of CDFI lending portfolios were targeted to low-income families, high poverty communities, and underserved populations in 2019.

For individuals in those communities, they should consider working with a CDFI when seeking education or access to financing for themselves or their business.

An individual who has limited assets or credit history, as is often the case with disenfranchised groups, may need to seek out a CDFI to get started. On the other hand, a business owner who has a limited track record and wants to grow his or her business but cannot get approved for a loan by a typical bank, whether SBA-approved or not, may see success in working with a CDFI.

Regardless of the specific circumstances, CDFIs strive to roll up their sleeves and truly invest in the people from their target communities. If they are not able to make a loan today, they make an active effort to help their clients get to a place where they can lend to them tomorrow.

For a complete list of CDFIs, download the latest spreadsheet from the CDFI fund and find the one nearest you.

Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

Will founded Beacon with the mission to help the current generation of owners to retire while enabling the next to unleash their entrepreneurial spirit. He comes from a business background having graduated from the Wharton School with a B.S. in Economics.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino