Not quite ready to sell?

Subscribe to receive the latest resources for small business owners.

Most people associate Houston with its well-earned reputation as the center of the energy sector in the United States. The oil and gas industry has long fueled the city's growth and re-invested energy proceeds have allowed Houston to become one of the most economically diverse cities in the country. Now home to Texans working on everything from rockets to astroturf installation, there’s plenty of evidence to invest in the largest city in the South.

While other cities have been slow to recover post-COVID, Houston has emerged stronger than ever. The Port of Houston has solidified itself as the country’s top seaport and is positioned to benefit immensely as the supply chain loosens on the heels of the pandemic. With a world-class healthcare complex (and the density of talent that comes with it), Houston stands on firm footing to continue to grow. Then there’s the energy sector.

Oil and gas experienced 10-year highs after clawing out of the COVID lows. Energy has done so well, in fact, that it has proven to be even more resilient than some of the high-flying tech winners of the last few years. This has not only given the major energy players cash to roll into renewable investments but has had a variety of second-order effects, touching everything from real estate to the local restaurant industry.

That’s not to say everything is rosy right now. Houston is not immune to record-high inflation and the ensuing interest rate hikes that have made purchasing real estate and other leveraged assets more expensive. There isn’t much solace in the public markets as they struggle to orient around turbulent macro events. So what’s a Houston-area investor to do?

Houston, we have a solution

We believe small businesses form the backbone of the American economy, providing all of us with essential goods and services and employing over 60 million people. Our goal is to advance American small businesses by giving entrepreneurs access to an asset class that was previously difficult to find, conduct due diligence on, and acquire.

What that means for Houston entrepreneurs is that your investment stays in one of the most robust markets in the country (the greater Houston metro) and in one of the most proven assets (cash-flowing small businesses). We also work with customers to explore financing options as there are a number of compelling options available to buyers in this category.

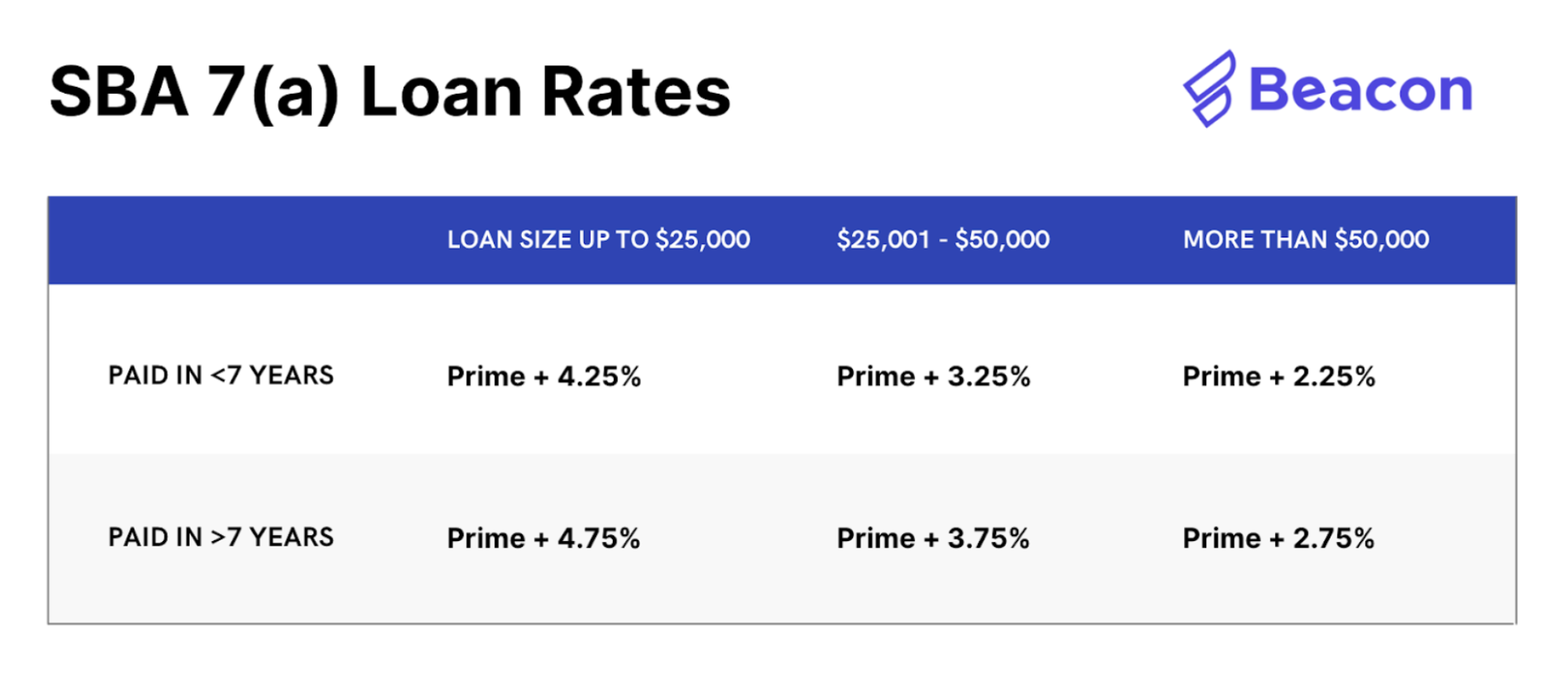

The SBA (Small Business Administration) allows buyers to secure favorable loan terms, even in a high-interest rate environment. SBA loans are government-backed but provisioned via financial institutions such as banks and credit unions. Last year alone the SBA approved 50,000 7(a) loans totaling $36.5 billion.

The SBA 7(a) is the loan type buyers most commonly use when acquiring a business. The federal government serves as the guarantor, giving small business owners the backing they need to insure loans up to $5 million. The important thing to know these days is that most SBA loans are variable and pegged to the prime rate. If you believe interest rates will eventually come back down to earth, your SBA loan will only become more affordable.

How Beacon works

We specialize in the “Main Street” category of M&A. These are businesses doing between $500K and $5M+ in revenue, have well-earned reputations in their communities, and generate consistent cash flow. We work with the owners of Main Street businesses to find prospective buyers to structure a deal.

Beacon provides a number of services to owners. First, we give owners peace of mind with our proven, confidential, sales process. Owners can opt-out at any time with only 30 days’ notice. Beacon covers all marketing costs until the business is sold (which is typically ~6 months), at which point Beacon receives a sales commission.

Business owners benefit from the support of a Transaction Advisor throughout the course of the entire process. Our advisors are skilled professionals who work on your behalf so that you can stay focused on running your business. As much as our Transaction Advisors help guide you along the way, the biggest benefit we offer business owners is our stable of qualified buyers.

Buyers prefer Beacon because of the quality of the deals we bring to market and the clarity by which they’re presented. We vet buyers' creditworthiness, confirm liquid assets, and assess the individual’s overall fit for the business before we set up owner meetings. This ensures both parties are mutually aligned and have a positive experience with Beacon.

We’ve found that strong buyers beget strong sellers and vice versa. It’s a virtuous cycle that results in the advancement of Main Street.

Beacon in Houston

Beacon is headquartered in Austin but features listings throughout the country. We’re proud to call Texas home and enable entrepreneurs in our own communities to achieve their dreams of ownership. As the largest city in our home state, we’re excited to give Houston the attention it deserves in the coming months. If you’re a Houston-area small business owner or an entrepreneur interested in owning a cash-flowing business, we’d love to chat.

Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

Anthony is the Marketing Lead at Beacon. He previously spent his career working for software companies in Silicon Valley but is now focused on making it easier to buy and sell Main Street businesses. Anthony studied Economics at Brown University and resides in Austin.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino